Your Trusted Public Adjuster in Michigan

Our public adjuster in Michigan is a licensed professional who works on behalf of policyholders like you, representing your interests in the insurance claim process following a property loss. A public adjuster’s interests are aligned with those of the insured, and their only mission is to get the best settlement for their client.

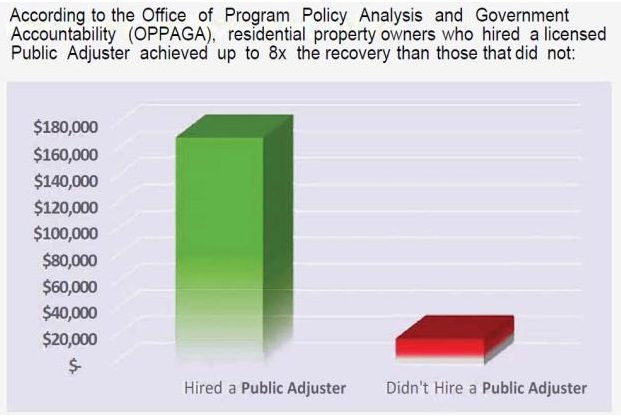

Statistically, claimants who utilize a public adjuster to advocate for their interests can achieve up to eight times (800%) the payout amount versus going through the insurance company’s adjuster.

Note: This statistic is from the Office of Program Policy Analysis and Government Accountability (OPPAGA), a government agency. Results will vary per claim, but it is typically a given that a public adjuster advocating for a claimant achieves an increase in the settlement amount from the insurance company that more than pays for the public adjuster’s fees by several times over.

Difference Between a Public Adjuster and Insurance Adjuster

Generally, there are three types of adjusters:

Staff Adjusters

Staff adjusters are salaried insurance company employees. Following your property loss, the insurance company sends its adjuster to assess the property losses. The adjuster estimates your property loss on behalf of the insurance company.

Independent Adjusters

Insurance companies typically hire independent adjusters on a contractual basis after a crisis such as a hurricane or hail.

Public Adjusters

Public adjusters only work on behalf of the policyholder to help them maximize the settlement.

Choose us whenever you are searching for a highly experienced public adjuster near you in Farmington Hills or anywhere in Michigan. We work to achieve the best insurance claim settlement for you.

The Insurance Company's Adjuster is Often Your Opponent

You may think that after your property loss, the insurance company will rush to help you, is on your side, and will immediately pay a claim. Sadly, this often is not the case. An insurance company is a “for-profit” entity. Insurance companies make money by receiving the hardworking monies of people like you as premiums and paying far less for claims.

Your insurance company will utilize its own adjuster who works for the insurance company. Often, the insurance adjuster aims to process and dispose of insurance claims as quickly as possible by either excluding or denying the responsibility of the insurance company to pay out or providing an opinion that minimizes the amount the insurance company will pay out on any covered claim.

This often leaves the policyholder with unexpected and significant gaps between the rebuild or repair cost of the damage and what the insurance company is saying they are willing to pay. You have the right to employ a public adjuster in the claim process, an insurance adjuster who works for you and advocates for your interests only.

Reasons for Hiring a Public Adjuster After a Property Loss

After a property loss, you may feel overwhelmed by the demands of the insurance process. You will have questions, concerns, and worries about the outcome of the claim you will make with your insurance company. There will be a tight schedule, and failure to meet deadlines in the claim process can lead to the denial of your claim. Your financial recovery depends on the proper handling of the insurance claim process.

Every insurance policy burdens the policyholder to prove the losses and the extent of the damages by a specific date and through proper documentation. Failure to do so may result in the insurance company rejecting the claim or approving only a partial payment. This is why hiring a dependable public adjuster near you in Detroit can greatly increase your chances of a favorable settlement.

Assessing property losses is often difficult and laborious as contents may have been destroyed by fire or a home otherwise unsafe to live in. Reading and understanding the legal jargon of an insurance policy is challenging. Insurance policies are written in favor of the insurance company, with more ways for the insurance company not to pay you on a claim than to pay out.

Do not navigate the landmines in an insurance policy by yourself. Let our public adjuster help you achieve the most favorable results.

The Role of A Public Adjuster

Picture the relief you will feel of employing a public adjuster on your side to hold your hand through the entire insurance claim process, fight for your rights, appraise your losses, file the claim accurately and timely, advise you through the entire claim process, and dealing with all aspects of the claim. Insurance companies are required by law to treat your claim “fairly.” What is “fair” is a grey area and gives the insurance company a lot of wiggle room to deny or reduce claims.

The insurance company’s adjusters can interpret insurance law and raise questions about the validity of your claim, which results in the exclusion of coverage or greatly reduces what the insurance company claims it is responsible for paying. Additionally, the insurance company’s adjusters will come out to any property loss and estimate/appraise the loss. This is the insurance company’s opinion.

An opinion that is often less than the actual damage and minimizes what the insurance company pays out. An opinion that can and will be challenged by your public adjuster. The insurance company is not going to be impartial. You need your own advocate. Contact Adjusters of Michigan today whenever you are looking for a “public adjuster near me in Grand Rapids” to learn more about how we can help you.