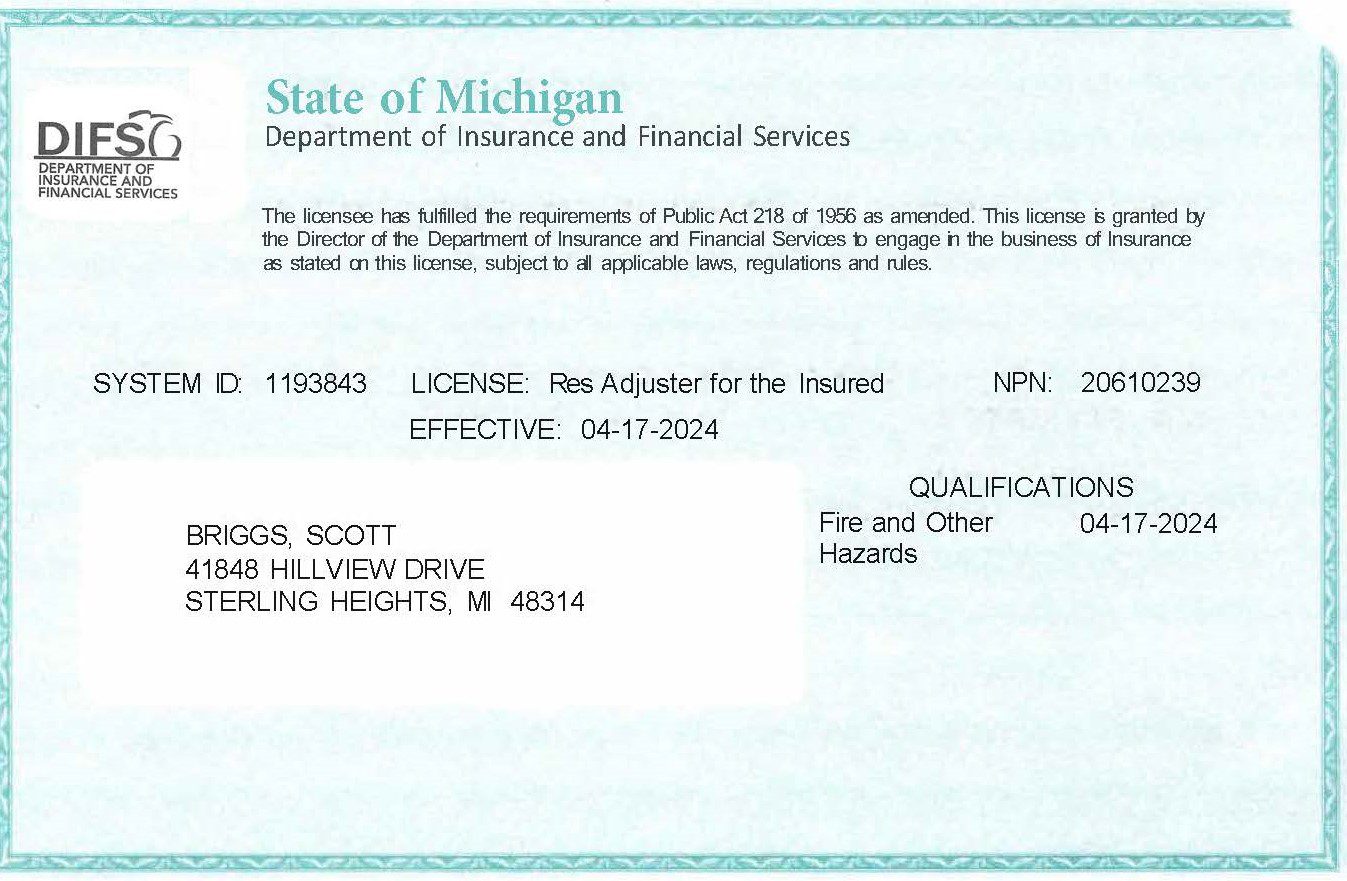

Navigate an Insurance Claim with Our Licensed Public Adjuster in Michigan

Navigate an insurance claim in Michigan with us. We can help simplify complex legal terms, which often favor insurance companies, for you. Insurance companies typically aim to minimize payouts, making it essential to have support throughout the process.That’s why seeking help from us, a dependable public adjuster near you in Sterling Heights, is a wise decision.

We’ll help you handle the complex insurance claim process efficiently. We do this by evaluating your insurance policy, creating detailed inventories of losses, and ensuring that every aspect of the claim is substantiated. By entrusting a public adjuster with your claim, you can avoid facing the insurance company alone. We’ll advocate for you and negotiate the best possible settlement, making it challenging for the insurance company to reject your claim based on technicalities.

If you have ever had an encounter with law enforcement, a district attorney/prosecutor, or a court, you know what it can be like to have someone question you in a manner that makes you very uncomfortable. Do not talk to insurance companies by yourself. Contact our public adjuster near you in Lansing. We’ll help you navigate your insurance claim in Michigan efficiently.

Our Tasks

Our public adjuster near you in Ann Arbor will help the insureds through the entire claim process by:

- Evaluating the insurance policy to establish the best strategy for success.

- Preparing a detailed inventory of the losses and substantiating every aspect of the claim, making it difficult for the insurance company to reject the claim on documentation or other technicalities.

- Filing the claim with your insurance company, we advocate and negotiate for the best settlement for you throughout the entire process.

The Cost of Hiring a Public Adjuster vs. an Attorney

Legally, you can speak with your own insurance company and represent yourself. However, in practice, you should not talk to the insurance company alone, as that will adversely impact your claim. You need your own advocate. Whether you hire a public adjuster or an attorney to navigate your insurance claim is up to you, but here are the differences you should consider:

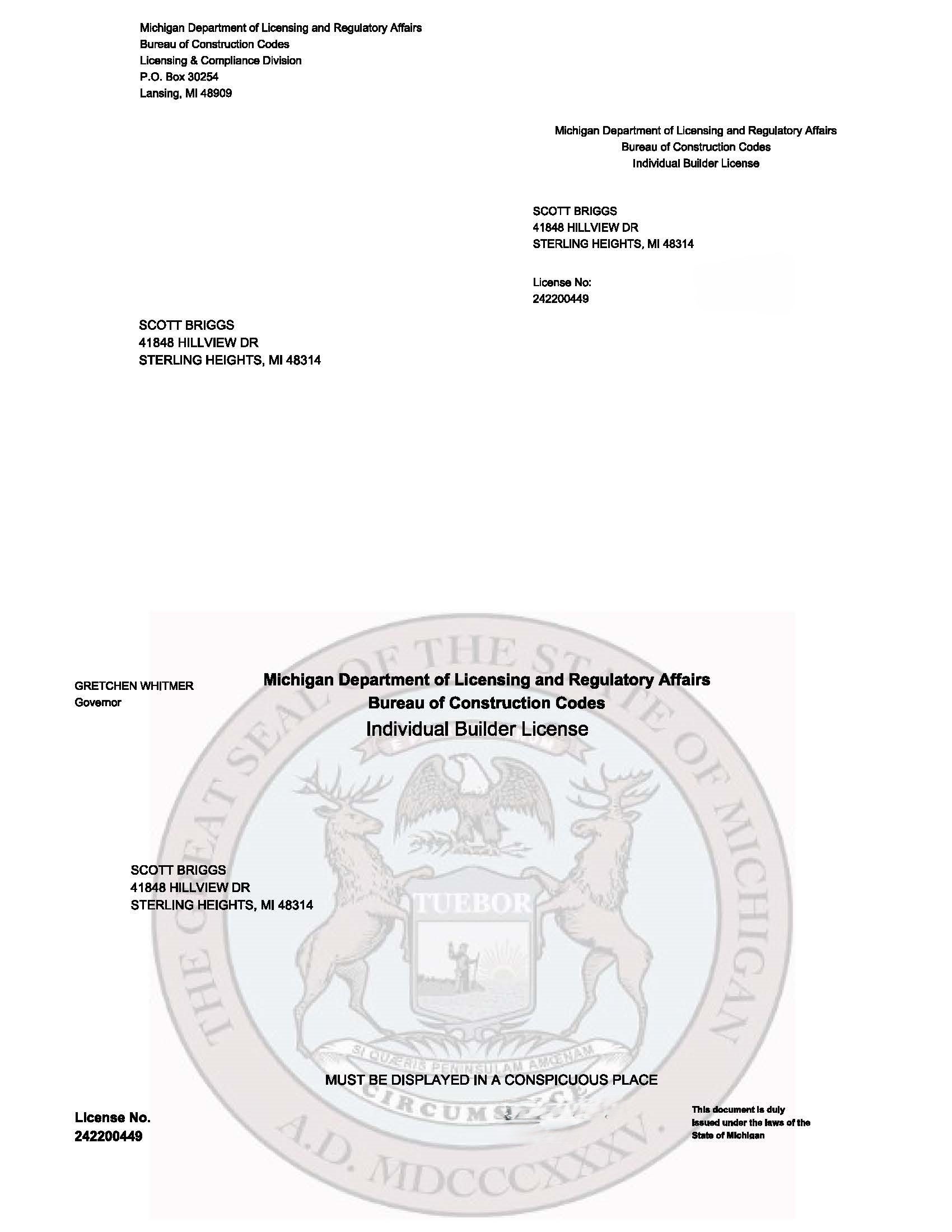

- In some states, including Michigan, a licensed attorney can adjust insurance policies without being licensed as an insurance adjuster. However, such attorneys are forbidden from advertising themselves as a licensed insurance adjuster unless they pass the insurance adjuster’s licensing exam.

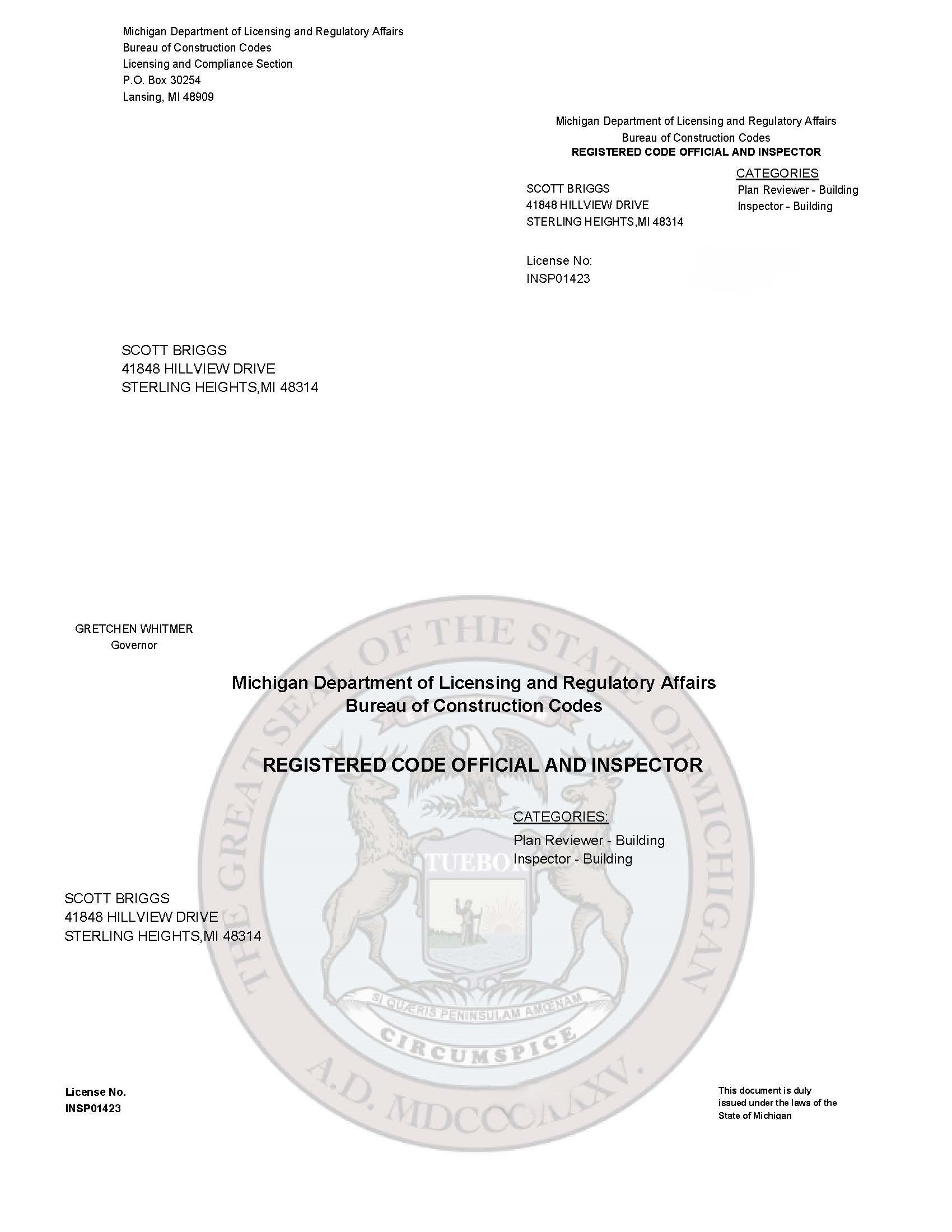

- Attorneys specialize in different fields of law. Just because an attorney who previously did something like social security disability law or immigration can legally adjust insurance claims does not mean that an attorney is truly the best advocate for a claimant. Insurance adjusters are specifically qualified and trained.

- Adjusters use very expensive subscriptions to software such as Xactimate, which costs around $3,000 a year. Failure to adjust claims with the tools accepted by the industry may lead to a denied claim. The insurance company will run its materials, repair, and labor estimates through insurance adjuster software.

Software and procedures that the standard attorney has no knowledge of or experience in, but your public adjuster would know. An attorney can read contracts, negotiate, or yell at the insurance company; however, if an attorney is not familiar with documenting loss and proving it with what is acceptable to the insurance industry, then the results of utilizing an attorney may or probably will be less after attorney fees than utilizing a public adjuster.

- An attorney typically will charge you by the hour at $250 to $400 an hour, plus charging fees for phone calls, emails, postage, driving, etc. If an attorney does not charge you by the hour, they typically charge a 33% contingency on the claim amount plus costs for copying, emails, driving, and other fees that they term “their out of pocket.”

- Attorney licenses are often state-specific licenses. They must go through that state bar for a license to represent someone. In comparison, the insurance industry is relatively uniform. Our licenses have reciprocity across the country in 47 states but California, New York, and Hawaii.

- A public adjuster gets a small percentage of your settlement, usually 10%. A far lesser amount than what attorneys charge. You do not have to pay anything out of your pocket to employ a public adjuster. They are only paid when you are paid by the insurance company on the settlement/claim.

Unlike attorneys who charge to send an email, make a phone call, or make a photocopy, most public adjusters do not charge in such a manner. Remember that statistically, claimants who utilize a public adjuster to advocate for their interests can achieve up to 8 times (800%) of the payout amount versus going through the insurance company’s adjuster.

Contact Us

Do not navigate the insurance claim landmines in an insurance policy by yourself. Contact us whenever you need a public adjuster near you in Rochester Hills.